Low-income seniors in Ontario can expect several helpful financial benefits this May 2025 to support their everyday living expenses. With rising costs of living, these payments provide much-needed relief, ensuring seniors have access to income support, housing assistance, and essential health services. Below is a comprehensive breakdown of all the provincial and federal financial benefits Continue reading

Blog

Your blog category

Popular Dessert Recalled in Canada Over Dangerous E. Coli Contamination — Check Your Freezer Now

The Canadian Food Inspection Agency (CFIA) has issued an urgent food recall warning involving a well-known frozen dessert product sold across parts of Canada. The alert pertains to Poppies Mini Éclairs, a popular treat among Canadian dessert lovers, which has been recalled due to potential generic E. coli contamination. The CFIA confirmed that the recalled Continue reading

8 Stunning New Bushes With Purple Flowers to Plant in Summer 2025 for a Gorgeous Garden Upgrade

Looking to add a regal and romantic touch to your landscape? A bush with purple flowers is the perfect way to add depth, color, and year-round interest to your garden. Whether you’re aiming for subtle lavender hues or bold violet bursts, there’s a perfect bush with purple flowers for every yard, climate, and garden size. Continue reading

Tariffs to Trigger Price Hikes at Loblaw and Walmart: What Canadian Shoppers Need to Know in 2025

Canadians are bracing for another round of rising grocery prices, as the impacts of the ongoing trade war between the U.S. and Canada begin to show up on store shelves. Major retailers like Loblaw and Walmart are warning that customers should expect to pay more for everyday essentials in the coming weeks and months as Continue reading

Ontario Child Benefit Payment Arriving May 20, 2025: Check Eligibility and Amounts Now

Ontario families, mark your calendars: the Ontario Child Benefit (OCB) payment is scheduled to be deposited on Tuesday, May 20, 2025, following the Victoria Day long weekend. This monthly benefit provides crucial financial support to low- to moderate-income families with children under 18. Here’s what you need to know about eligibility, payment amounts, and how Continue reading

11 Invasive Weeds with Purple Flowers That May Be Wrecking Your Lawn & How to Stop Them Fast

Weeds with purple flowers might look charming at first glance, but don’t let their beauty fool you. Many of these vibrant, flowering intruders are aggressive, fast-spreading, and can quickly take over your lawn or garden if not properly identified and controlled. Whether it’s wild violets sneaking through your turf or purple loosestrife choking out native Continue reading

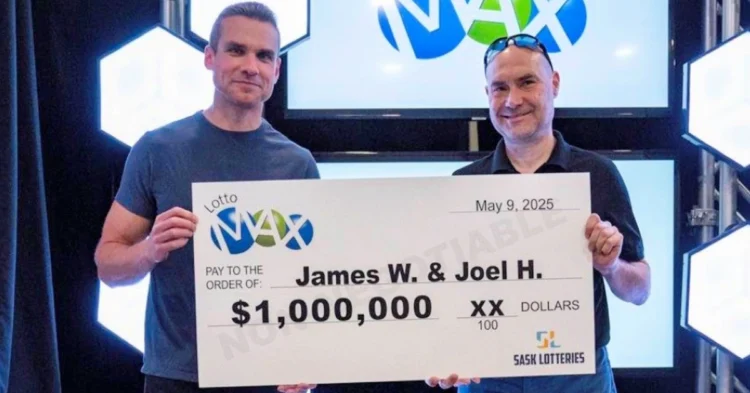

Saskatoon Friends Win $1 Million in Lotto Max MAXMILLIONS Draw After Scanning Shared Ticket Multiple Times

A Shared Routine Turns Into a Life-Changing Win Two close friends from Saskatoon, James Wawryk and Joel Hedlin, are now millionaires after scoring a $1 million prize in the Lotto Max MAXMILLIONS draw held on April 25, 2025. The pair matched all seven numbers on one of the MAXMILLIONS selections, making their long-standing ticket-sharing tradition Continue reading

6 Must-Have Trees With Purple Flowers in your Garden for Privacy, Pollinators, and Edible Blooms

If you’re looking for a tree with purple flowers to add a splash of color and elegance to your garden, you’re in luck. Not only do these trees bring beauty and shade, but some even offer delightful fragrances and edible blossoms. As someone who once tasted the sweet, honey-like petals of a locust tree behind Continue reading

Windsor Bus Driver Plans Early Retirement After Winning $1 Million Lotto 6/49 Encore Prize

A Life-Changing Morning Email Brings Unexpected Fortune For Brandon Stewart, a hardworking transit bus driver from Windsor, Ontario, the path to early retirement just became a lot smoother. Thanks to his regular participation in the Lotto 6/49 with Encore, Stewart is now celebrating a $1 million lottery win that he describes as a “decent return Continue reading

GM Issues Major Recall in Canada for 6.2L L87 Engine Over Risk of Engine Failure: Affects Nearly 50,000 Trucks and SUVs

General Motors (GM) has announced a widespread recall in Canada impacting nearly 50,000 vehicles equipped with its powerful 6.2L V8 L87 engine. The recall, which affects full-size pickup trucks and SUVs from model years 2021 to 2024, was issued due to serious manufacturing defects that could lead to loss of propulsion, engine damage, or total Continue reading